Made in China 2025 - 9 years later

2024-11-14

I had the opportunity to read Marco Rubio's latest report on Made in China: 2025 (MIC2025) - a Chinese government program initialised in 2015 as part of its plan to dominate world trade in high-value, high-technology sectors of the future.

Through this program China intends to ultimately overtake the US to become the world leader in the most advanced technologies. Rubio's report focuses on the progress made so far, 9 years after the program was initiated.

I wanted to write an article on this because the report actually blew my mind. China is much more advanced in many more sectors than I realized, and this report really lays that bare. It's all the more significant given that Rubio is an established China hawk and has no reason to tout their successes.

The overall conclusion of the report is that China has already met its goals through this program, even though its development has been uneven:

China has reached, or is near to reaching, the technological cutting edge in most of the sectors it has targeted.

Of the 10 sectors targeted by MIC2025, China can credibly claim to be the world leader in four: Electric Vehicles, Energy and Power, Shipbuilding, and High-speed Rail.

In five sectors, China has made substantial progress toward the technology frontier, but is not yet a leader: Aerospace and Aviation, Biotechnology, New Materials, Robotics and Machine Tools, and Semiconductors.

If Xi Jinping were a fund manager, he would have every reason to be pleased with the performance of this portfolio. China’s investments have generated outsized returns in not one, but several sectors.

I will summarize the report below and include tidbits that I found particularly interesting.

General state of play

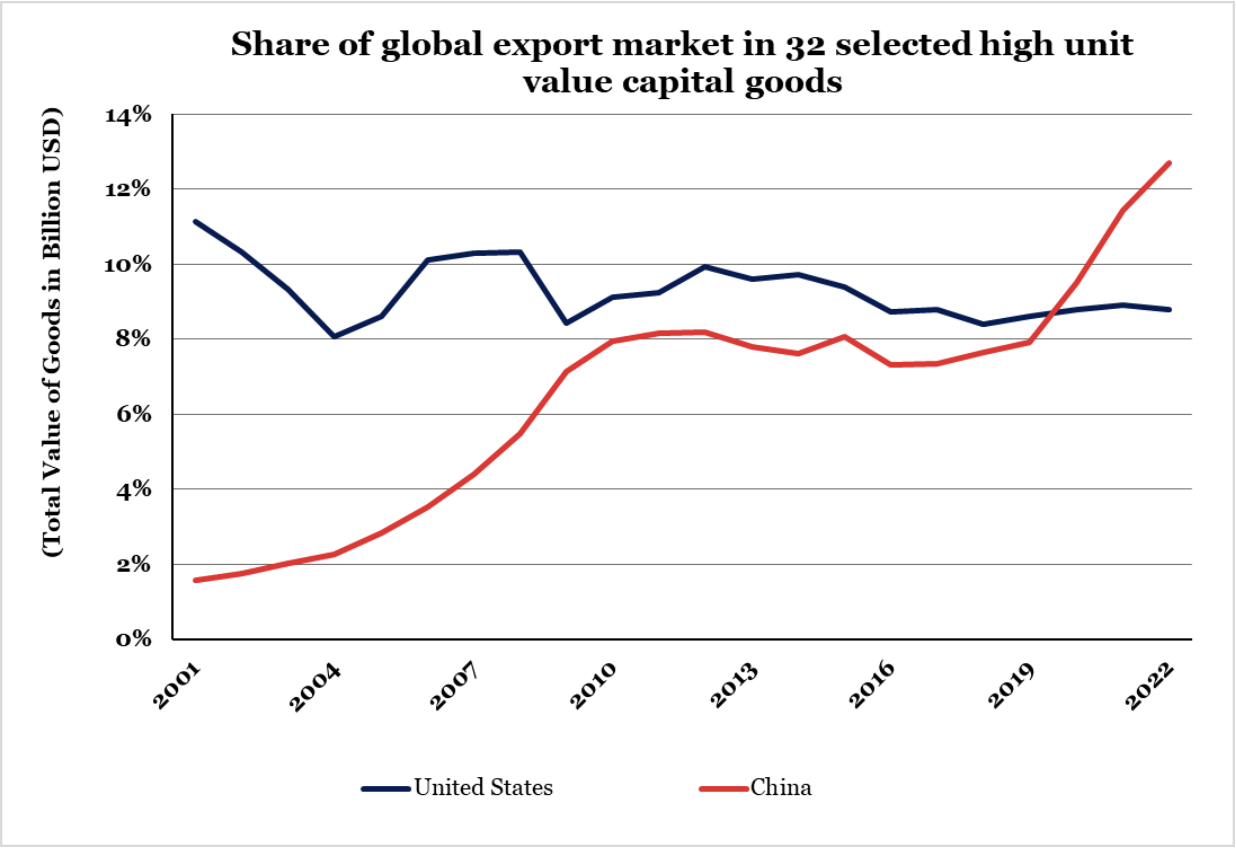

China's share of the gobal export market in 32 selected high value goods has already surpassed that of the US:

In the Global Innovation Index - which ranks countries according to innovation capability - , China's ranking went from 29th in 2015 to 12th in 2023. China scores well in manufacturing-related innovation but less so in environmental metrics, political and regulatory environments, and software-related online creativity.

China now leads the world in producing high-quality research in 37 out of 44 critical technologies, including every technology related to manufacturing.

Since 2020, China has filed the most international patent applications of any country. Huawei files the most international patent applications of any company in the world. Besides Huawei, three other Chinese companies are in the top 10 in terms of patent filings.

In terms of basic inputs to manufacturing such as steel and cement, China leads the world. It uses as much cement in two years as the U.S. used in the entire 20th century. As for steel, In 2022 China produced over 1bn tonnes of crude steel; India came second with a comparatively meagre 125 tonnes.

Overall, Chinese companies dominate global rankings of the largest companies by revenue. In 2023, the number of Chinese companies on the Fortune Global 500 was higher than the number of American companies, 142 to 136. However, many of its largest companies are state-owned enterprises.

And although China has strong world-leading brands such as Huawei, Tiktok and BYD it has produced fewer such brands than would be expected given the strength of its industrial base.

Sector 1 - Aerospace and Aviation

Alongside the US and Russia, China is only the third country capable of launching humans into space. It is also the only country with an independent, permanently crewed space station (Tiangong 天宫).

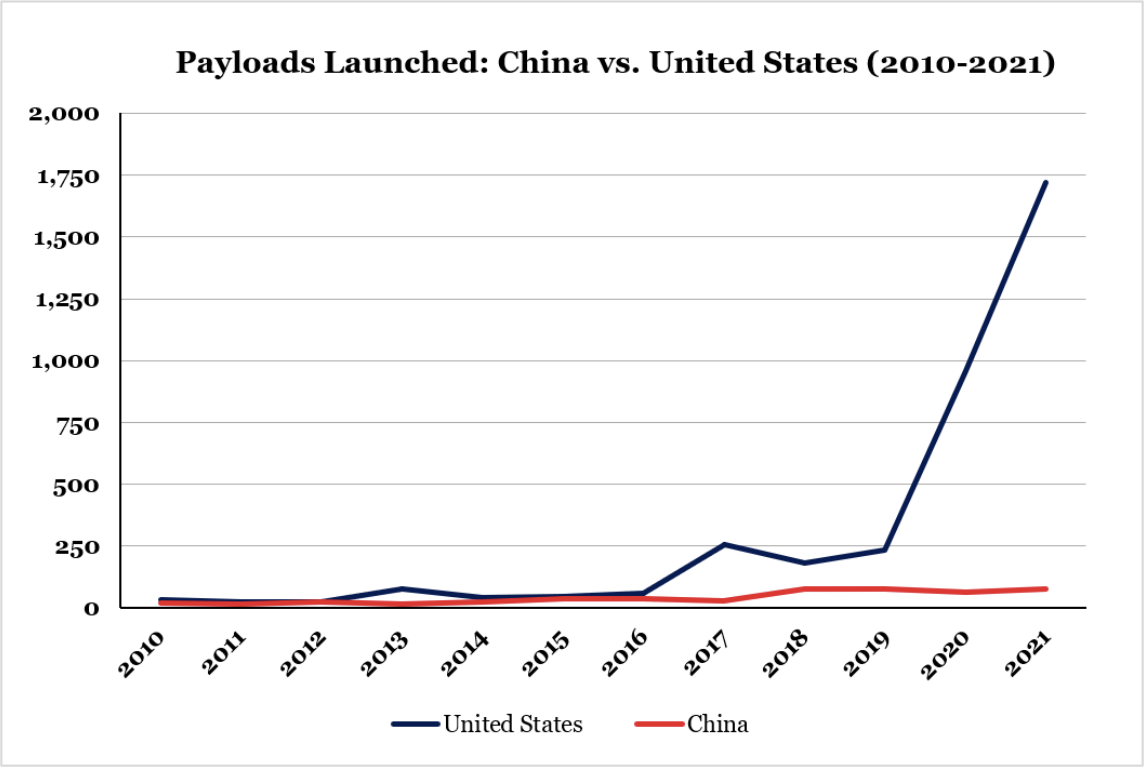

Thanks to SpaceX the US leads China in terms of payloads launched per year, reusability technology and even super-heavy launch capability (Starship):

(Note: As DongFangHour reports, China has a very active private space industry, with multiple players competing to build reusable rockets and launch Starlink-like constellations for satellite internet.)

Regarding satellite navigation:

BeiDou is now twice the size of GPS, is more accurate — particularly in the developing world, and has more features.

China's passenger jet champion - COMAC - has so far failed to break the Airbus-Boeing duopoly. Most of their orderbook remains domestic. The main issue they face is inferior tech - their C919 aircraft weighs more and has a shorter range than its comparable alternatives. 40% of the aircraft components - including critical components such as the engine - remain foreign manufactured. They are many years away from being fully indigenously made.

China's big success in this sector is their drone ecosystem. They are encouraging the development of the "low-altitude economy", envisioning the use of drones for everything from package delivery to taxi services.

Meanwhile, they have already captured 90% of the U.S. market for commercial drones.

Sector 2 - Agriculture

China does not grow enough food to feed itself and runs an annual trade deficit in agriculture, reaching $135bn in 2023. China's most acute import needs (soybeans, corn, dairy, etc) come from the US and allied countries, making this sector a huge national security risk for China.

They have attempted to convert more arable land for agricultural use but the results have been a failure so far, with the amount of cultivated land actually falling between 2015 and 2023.

China's biggest export market for tractors is Russia where trade has quadrupled since the start of the Ukraine war. Despite a surplus trade in tractors and other machinery, China has yet to produce a world leader in agricultural machinery manufacture.

Sector 3 - Biotechnology

China is the world leader in producing low-end Active Pharmaceutical Ingredients (APIs) and, together with India, produces upto 70% of the generic drugs sold in the US.

China leads in research of four out of seven biotech categories: synthetic biology, biological manufacturing, genome and genetic sequencing and analysis, and novel antibiotics and analysis. In contrast, the US leads in vaccines and medical countermeasures, genetic engineering, and nuclear medicine and radiotherapy.

China remains behind the pack in drug disovery and creating novel medicines and therapies. However, it is slowly catching up thanks in part to domestic firms started by Chinese nationals who have returned from studies and/or work stints abroad in the Western pharmaceutical sector.

Sector 4 - Electric Vehicles (EVs) 🏆

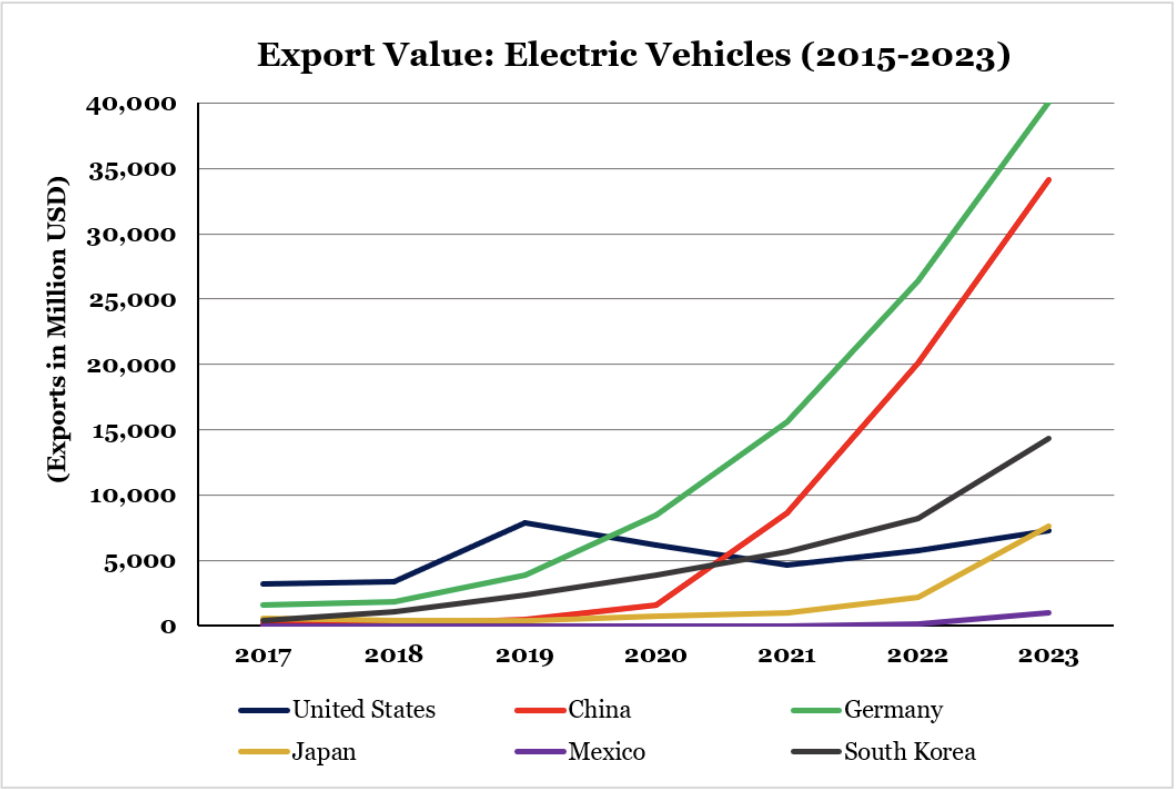

China is the world leader in this sector in terms of both technological innovation as well as production.

-

Thanks to sustained investment and focus on battery technology, drivetrains, and other fundamentals, Chinese automakers are producing EVs of impressive quality, with strong range, innovative features, and luxury stylings.

China's subsidies to its EV industry exceeded $60bn in the 2009-2017 timeframe.

It originally set a goal of 3m domestic EV sales per year by 2025. In 2023, 6m EVs were sold domestically, plus an additional 2.8m plug-in hybrids. It exported nearly 5m cars of all kinds in 2023, dethroning Japan as the world's largest auto exporter.

BYD is one of the most successful EV companies. Since batteries make up approximately 40 percent of the cost of an EV, BYD's history as a battery maker allowed it to create a battery that was thinner, cheaper, and safer than competitors on the market. This enabled it to slash prices, and in Q4 2023 it dethroned Tesla in new EV sales.

There are now hundreds of domestic EV companies and competition is intense, with the expectation of a price war resulting in "battle-hardened" EV companies emerging that will be even more competitive on the world stage.

Sector 5 - Energy and Power 🏆

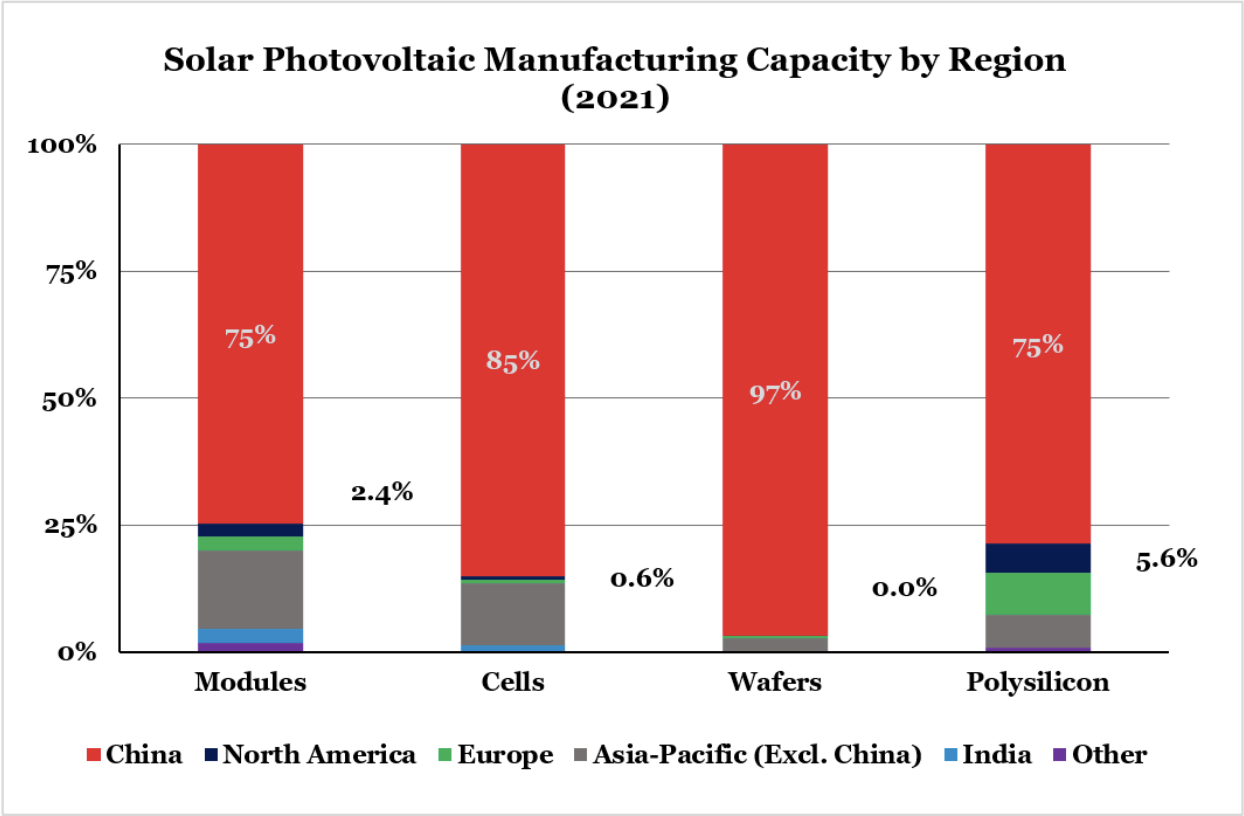

China's share of the global solar power supply chain is >80%. It has been able to undercut every other country on solar panel pricing:

Chinese solar panels are so cheap they are being used as fencing and paving materials in some parts of Europe.

China also leads the world in nuclear power generation technology and began the world's first and only fourth-generation nuclear reactor in 2023. It has also recently finished building the world's first Thorium-based Molten Salt Reactor (MSR) thanks to technological know-how transferred from Oak Ridge National Laboratory in the US during the Obama era. However, China's exports in nuclear energy technology are yet to really take off with Pakistan so far being the only purchaser.

Turning to power generation and transmission:

State Grid is China's largest state-owned utility. It is the third-largest company in the world by revenue after Walmart and Saudi Aramco, and has more than a million employees.

State Grid plans to invest $70bn in China's grid in 2024. They are at present still a long way off from fulfilling their vision of a "super grid" that connects the entire country - such is the scale of the challenge. However, they are also exporting their tech, with projects in 51 countries as of 2021.

Sector 6 - High-speed rail 🏆

China has the largest high-speed rail network in the world stretching a total of 28,000 miles - twice its length from a decade ago. The Chinese government considers it to be a public good essential for economic development and maintaining control over the nation, which is why it has built it so quickly by taking on massive debt:

In late 2022, China State Railway Group reported holding more than $890 billion in debt—an amount equal to five percent of China’s GDP at the time.

China uses high-speed rail as a form of debt-fueled stimulus - "Railway Keynesianism". Construction of high-speed rail employs hundreds of thousands of workers and ensures continuing demand for cement and steel from Chinese factories.

Rail projects with foreign countries are an important diplomatic component of China’s Belt and Road Initiative. The Chinese government subsidizes such projects to bring more countries into China's sphere of influence and to facilitate exports for Chinese companies such as CRRC - a state-owned rolling stock manufacturer that is now the world's largest.

Sector 7 - New materials

China has created a massive R&D complex to catch up with competitors in material science output. As a result, Chinese institutions are now the ones publishing the most highly-cited, high-quality research in numerous fields such as nanoscale research:

Nine out of the top ten institutions in this field as measured by the Hirsch index — a metric of scholarly impact — are in China, led by the Chinese Academy of Sciences.

China’s new materials industry has had a Compound Annual Growth Rate (CAGR) of 20% since 2015, compared to a global 10%. Its material industry now accounts for 30% of global output.

However, China has yet to make many "epoch-making" breakthroughs in material science. This is partly because investment still lags other countries and a difficulty in attracting young Chinese talent to this field compared to fields such as computer science.

Of particular note is carbon fiber. Though China is the dominant producer of mid-grade fiber (43% of global output) a multilateral ban on exporting high-grade fiber - so-called "T1000" fiber - has held China back in strategic industries like aeronotics where China currently lags world leaders. However, in 2023 China announced the ability to mass-produce high-grade fiber on its own thanks to its materials research efforts.

Sector 8 - Robots and machine tools

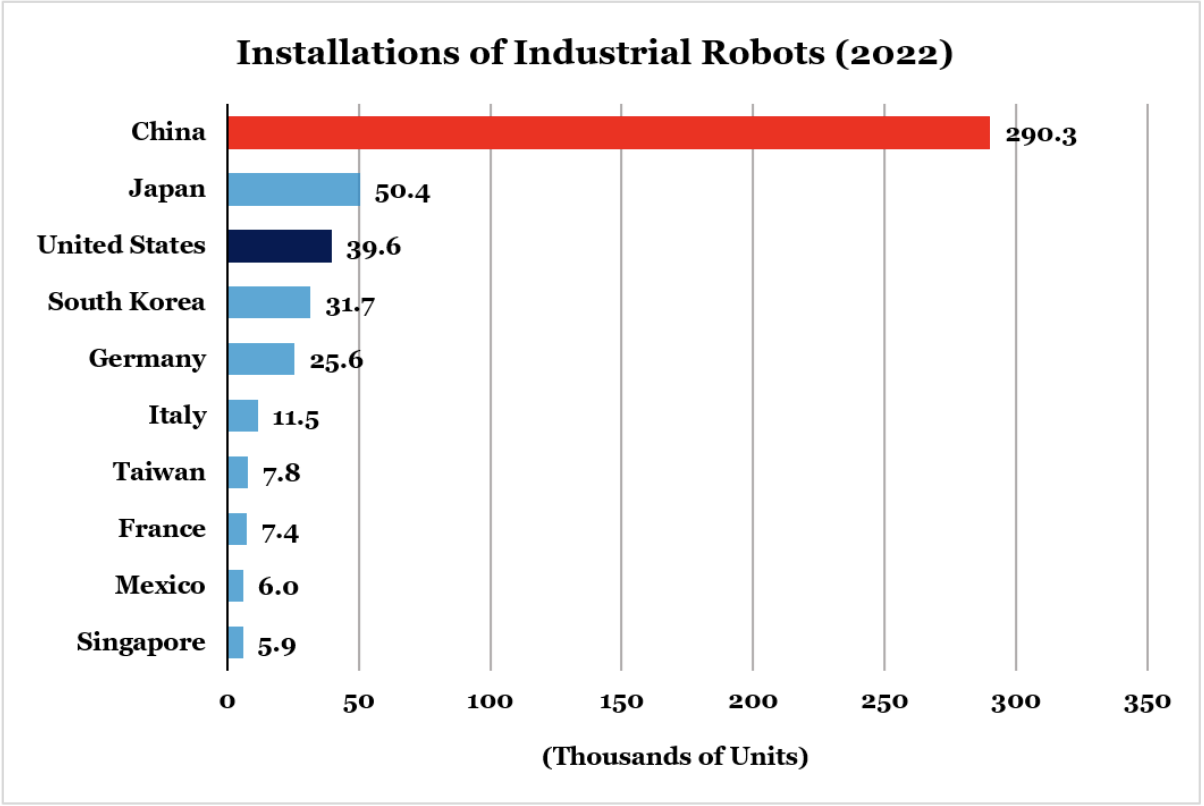

As the pool of Chinese workers shrinks due to demographic change, promoting "smart manufacturing" involving the use of advanced industrial robots is a high priority for China:

Smart manufacturing integrates digital technology and automation into factory settings to monitor production, increase productivity, and reduce downtime and reliance on line workers.

China leads the world in installations of industrial robots and installed more robots in 2022 than the rest of the world did combined. Its smart manufacturing is also enabled by its world-leading telecommunications network - 3.5 million 5G base stations.

China does not yet have a world-leading, home-grown robotics manufacturer. Its most valuable company is KUKA, a Bavarian manufacturer which Chinese company Midea bought in 2016. KUKA supplies to various US and European manufacturer including Tesla for its Gigafactories.

However, numerous Chinese home-grown farms have been slowly working on changing the status quo and now account for 35% of domestic robot sales, up from 17.5% a decade ago. They have ambitions of capturing a signficiant share of the global market within the next 5 years.

As for machine tools, Chinese producers accounted for nearly a third of global output in 2022. Though Chinese firms aren't yet significant players in the high-end tools market - e.g Computer Numerical Control (CNC) machines - they are fast evolving in terms of their offerings.

Sector 9 - Semiconductors

China has given special attention, including subsidies, to its semiconductor industry as it correctly recognizes that this sector underpins numerous others.

Despite spending potentially more than $150bn via state-run investment funds to boost this sector China still lags competitors in terms of its ability to produce the most advanced microchips that, for example, power smartphones and AI apps. It remains reliant on foreign countries for key inputs including Extreme Ultraviolet (EUV) lithiography machines, Electronic Design Assistance (EDA) software, and advanced semiconductor materials.

Despite pushing the boundaries of what's possible with older technology and achieving some notable success (e.g Kirin 9010 chip using 7nm node tech), Chinese firms are still several generations behind the leading edge (such as TSMC in Taiwan).

However, China's efforts have also resulted in some success such as producing the world's most advanced commercially available NAND memory product. In conjunction with this, China already controls 27 percent of global foundry capacity in the 20-45nm node range. These chips go into refrigerators, automobiles, airplanes and weapons systems. Another point of strength for China is in Assembly, Test and Packaging (ATP). Though lower value and labour intensive, China is fast establishing a dominant position in this sector.

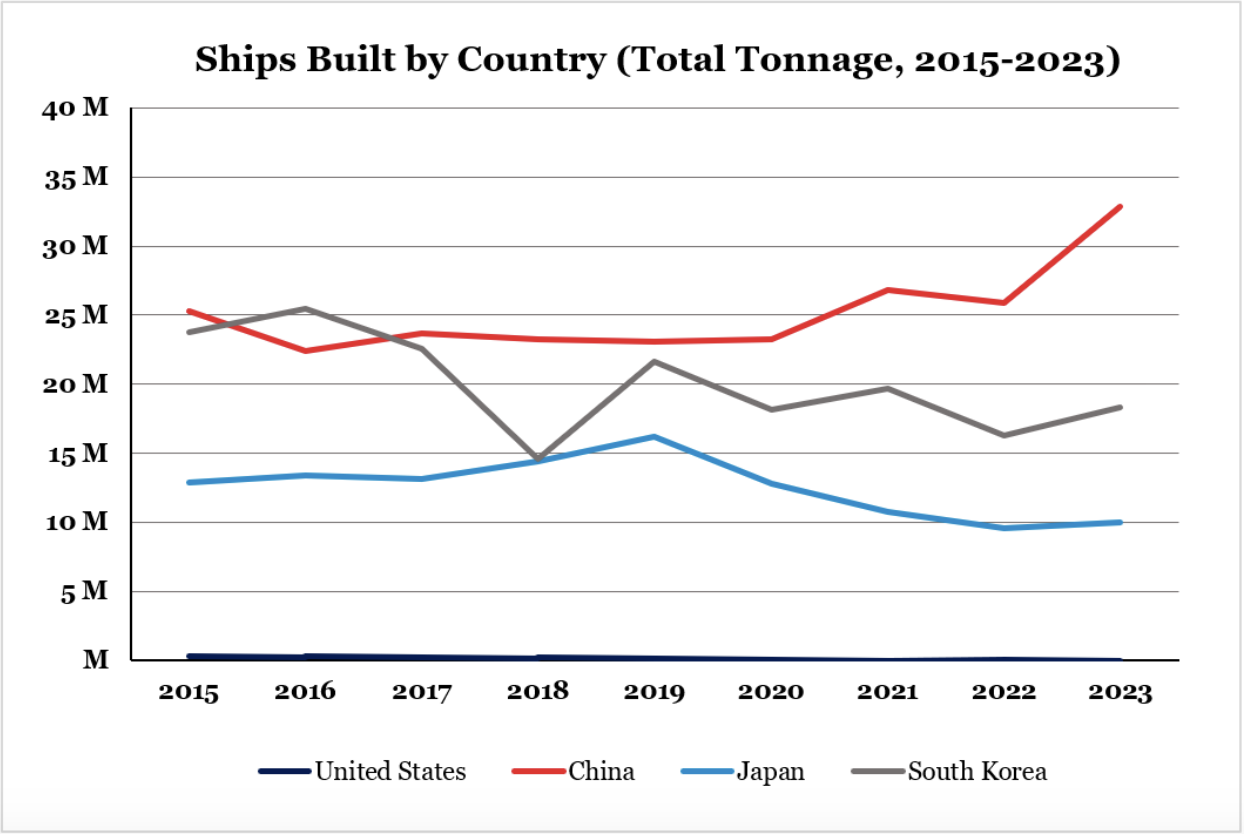

Sector 10 - Shipbuilding 🏆

China is by far the world’s largest shipbuilding power by tonnage. Chinese shipyards float as much tonnage each year as the rest of the world’s shipyards combined. China has also shown it's capable of building the largest and most sophisticated types of ships:

The three "crown jewels" of the shipbuilding industry are aircraft carriers, liquified natural gas (LNG) tankers, and luxury cruise ships. China has proven its mettle in all three areas.

China's shipbuilding prowess also provides a massive boost to its trade and exports:

Chinese-built roll-on/roll-off (RORO) ships are ferrying Chinese-made automobiles to foreign markets. BYD alone plans to own eight such vessels within two years, each capable of carrying thousands of cars.

China is also expand its footprint in the Indo-Pacific through the development of offshore engineering and deep-sea exploration capabilities. The sea is believed to hold several times what land does of rare metals which are critical for almost all of today’s electronics and clean-energy products.

China holds five of the 30 exploration licenses that the International Seabed Authority (ISA) has granted to date — the most of any country. China will have exclusive rights to excavate 92,000 square miles of international seabed — about the size of the UK.

Sustainability, Reform and Going global

The latter part of the report focused on some of the lateral issues facing China, separate to sector-specific performance.

As we've seen already, China dominates in the production of renewable energy and green technology - e.g solar panels, wind turbines, nuclear power plants, EVs, etc. However, it also leads the world in the installation of renewable energy. It has more solar-farm capacity than the rest of the world combined. It also has 55 nuclear reactors in operation and 26 under construction.

And yet it also remains the world's worst polluter and emits the most greenhouse gas of any nation. And due to economic challenges as well as challenges with renewable energy it has recently shifted back to coal power reliance, permitting the approval of two coal power stations a week in 2023. Nearly all of the new global coal power to come online in 2023 was in China.

Must of this reflects China's continued emphasis on manufacturing prowess as the engine that powers China's economy:

When push comes to shove, Beijing has prioritized industrial strength over sustainability — gambling that it can produce its way out of its problems, including a shrinking population and high levels of debt. This choice reflects the stark reality that manufacturing is, and will be for the foreseeable future, a resource- and emissions-intensive activity. Despite Beijing's bold climate commitments, it wishes above all to be the world's dominant manufacturing power. Its actions and energy mix reflect that wish.

It's also worth noting that China's drive to decarbonize (such as its commitment to carbon neutrality by 2060) may be driven more by energy security than environmental concerns:

China is the world’s largest oil importer, importing 11 million barrels of oil per day. Most of these imports arrive by sea and transit the Strait of Malacca, leaving them vulnerable to blockade.

One of the other goals of MIC2025 was supply-side structural reform. The aim was to deleverage China's heavily indebted corporate sector and reduce excess capacity - for example, industries such as steel and coal production were too large even for China's domestic market:

As part of that campaign, China shuttered 290 million tons of coal capacity and 60 million tons of steel capacity, a monumental feat that, as the Economist recently noted, meant China had "removed more capacity in these industries than most countries have ever possessed".

However, China has so far taken only limited steps in downsizing industries and thus rebalancing its economy. This has resulted in unprofitable companies, leading to significant consolidations in many industries. However, the report points out that in at least some sectors it's possible that China views excess capacity as a point of leverage with which to control global markets:

The ability to flood the global market at any moment with excess magnets, for example, provides Chinese authorities broad discretion to set global prices and strategically undermine competitors abroad.

China wants its domestic giants to go global - this has been state policy since at least the mid 1990s. Firms like Lenovo and Sinopec were early participants in this policy, establishing overseas operations and reaping the benefits in terms of technology and talent.

In more recent years, as trade barriers against China have risen up in the West it has turned to the Global South as both an export market as well as for overseas manufacturing bases:

While Chinese exports to the United States have plummeted in recent years, they have come in through the back door; China’s exports to the Global South have risen in step with the United States' imports from the Global South, indicating massive circumvention of U.S. trade barriers. Goods are being shipped from China to third-party countries, re-flagged, then shipped to their final destination in the United States, a practice referred to as "transshipment".

Finally, Chinese companies are establishing global value chains, which include sophisticated factories that will allow them to enter foreign markets and tamp down criticism about export practices. These moves are tied to equivalent moves in the diplomatic sphere promoting the China's Belt and Road Initiative, thereby bringing countries further into China's sphere of economic and political influence.

Conclusion

Overall, the report concludes that China is a very real and serious threat to US supremacy in the economic sphere, and quickly becoming the same in military and geopolitical spheres. I agree with this assessment. Despite China's internal challenges such as food and energy insecurity, debt burdens and demographics, it is highly likely to continue consolidating its position and make further inroads in the sectors where it's relatively weaker compared to the West.